This transaction would reduce an asset (cash) and a liability (accounts payable). If an accounting equation does not balance, it means that the accounting transactions are not properly recorded. Owners can increase their ownership share by contributing money to the company or decrease equity by withdrawing company funds. Likewise, revenues increase equity while expenses decrease equity. A liability, in its simplest terms, is an amount of money owed to another person or organization.

Assets, Liabilities, And Equity

Refer to the chart of accounts illustrated in the previous section. Due within the year, current liabilities on a balance sheet include accounts payable, wages buy xero shoes at rei and get a $10 xeroshoes com gift certificate [1] or payroll payable and taxes payable. Long-term liabilities are usually owed to lending institutions and include notes payable and possibly unearned revenue.

Balance Sheet and Income Statement

It is equal to the combined balance of total liabilities of $20,600 and capital of $15,850 (a total of $36,450). Shareholder Equity is equal to a business’s total assets minus its total liabilities. It can be found on a balance sheet and is one of the most important metrics for analysts to assess the financial health of a company. As you can see, all of these transactions always balance out the accounting equation. This equation holds true for all business activities and transactions.

How to Build Conflict Resolution Skills: Case Studies and Examples

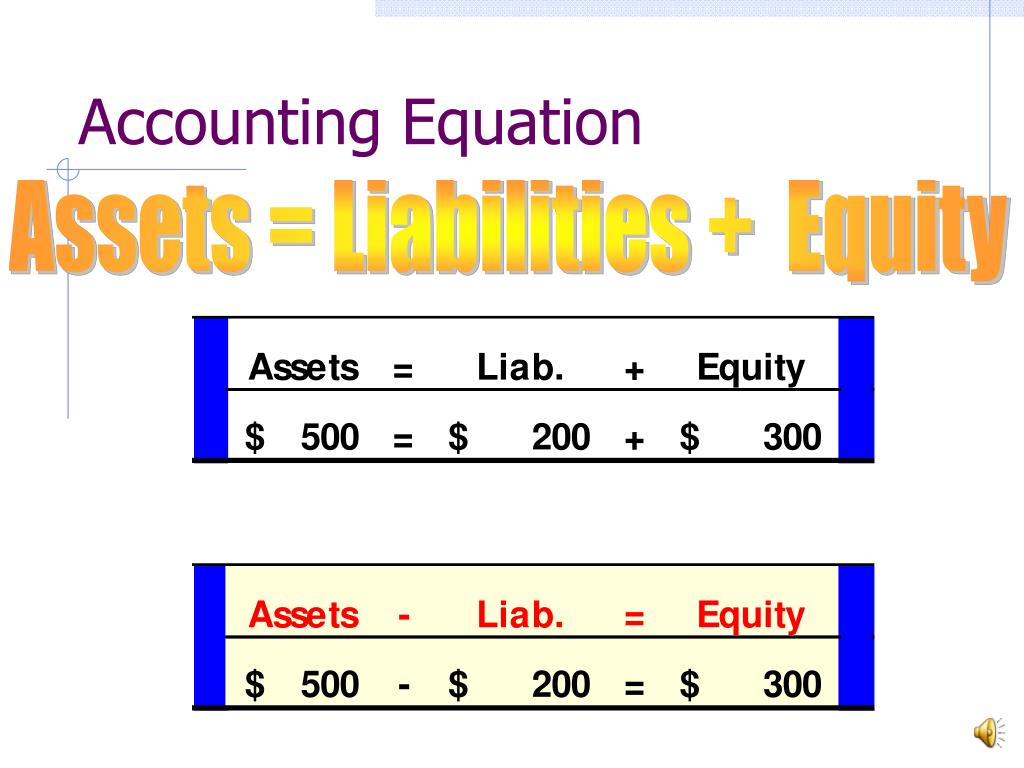

As transactions occur within a business, the amounts of assets, liabilities, and owner’s equity change. In the above transaction, Assets increased as a result of the increase in Cash. At the same time, Capital increased due to the owner’s contribution. Remember that capital is increased by contribution of owners and income, and is decreased by withdrawals and expenses. Like any mathematical equation, the accounting equation can be rearranged and expressed in terms of liabilities or owner’s equity instead of assets.

- Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit).

- For example, you can talk about a time you balanced the books for a friend or family member’s small business.

- Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting.

- The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet.

An accounting transaction is a business activity or event that causes a measurable change in the accounting equation. Merely placing an order for goods is not a recordable transaction because no exchange has taken place. In the coming sections, you will learn more about the different kinds of financial statements accountants generate for businesses. As business transactions take place, the values of the accounting elements change. The accounting equation nonetheless always stays in balance. We know that every business holds some properties known as assets.

Basic Accounting Equation Formula

All of our content is based on objective analysis, and the opinions are our own. The merchandise would decrease by $5,500 and owner’s equity would also decrease by the same amount. On 22 January, Sam Enterprises pays $9,500 cash to creditors and receives a cash discount of $500. On 1 January 2016, Sam started a trading business called Sam Enterprises with an initial investment of $100,000.

The accounting equation states that total assets is equal to total liabilities plus capital. This lesson presented the basic accounting equation and how it stays equal. The accounting equation asserts that the value of all assets in a business is always equal to the sum of its liabilities and the owner’s equity.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. The difference between the sale price and the cost of merchandise is the profit of the business that would increase the owner’s equity by $1,000 (6,000 – $5,000). In other words, all assets initially come from liabilities and owners’ contributions. Before taking this lesson, be sure to be familiar with the accounting elements.