You can find a company’s assets, liabilities, and equity on key financial statements, such as balance sheets and income statements (also called profit and loss statements). These financial documents give overviews of the company’s financial position at a given point in time. The accounting equation ensures the balance sheet is balanced, which means the company is recording transactions accurately. Income and expenses relate to the entity’s financial performance. Individual transactions which result in income and expenses being recorded will ultimately result in a profit or loss for the period.

Shareholders’ Equity

Debt is a liability, whether it is a long-term loan or a bill that is due to be paid. Metro issued a check to Office Lux for $300 previously purchased supplies on account. A financial professional will be in touch to help you shortly.

What is the approximate value of your cash savings and other investments?

This makes sense when you think about it because liabilities and equity are essentially just sources of funding for companies to purchase assets. Before technological advances came along for these growing businesses, bookkeepers types of purchase order processes and purchase order examples were forced to manually manage their accounting (when single-entry accounting was the norm). Of course, this lead to the chance of human error, which is detrimental to a company’s health, balance sheets, and investor ability.

The accounting equation And how it stays in balance

After six months, Speakers, Inc. is growing rapidly and needs to find a new place of business. Ted decides it makes the most financial sense for Speakers, Inc. to buy a building. Since Speakers, Inc. doesn’t have $500,000 in cash to pay for a building, it must take out a loan. Speakers, Inc. purchases a $500,000 building by paying $100,000 in cash and taking out a $400,000 mortgage. This business transaction decreases assets by the $100,000 of cash disbursed, increases assets by the new $500,000 building, and increases liabilities by the new $400,000 mortgage. Ted is an entrepreneur who wants to start a company selling speakers for car stereo systems.

- When the total assets of a business increase, then its total liabilities or owner’s equity also increase.

- Remember that capital is increased by contribution of owners and income, and is decreased by withdrawals and expenses.

- Debt is a liability, whether it is a long-term loan or a bill that is due to be paid.

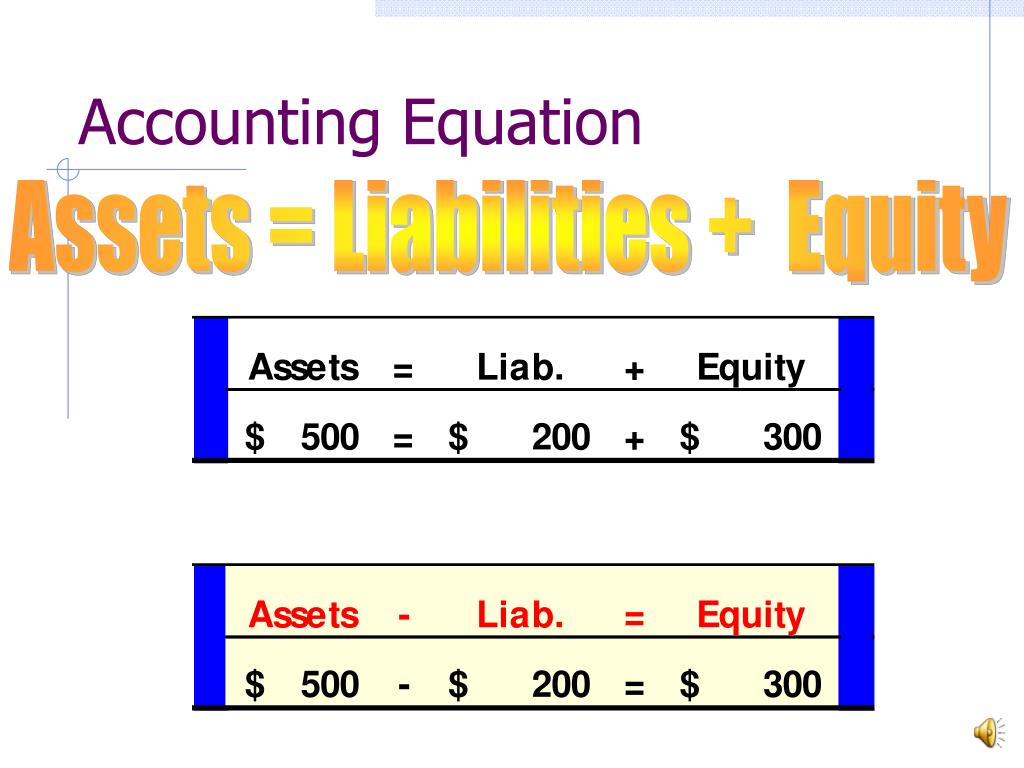

- In other words, we can say that the value of assets in a business is always equal to the sum of the value of liabilities and owner’s equity.

- Equity represents the portion of company assets that shareholders or partners own.

Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. Assets pertain to the things that the business owns that have monetary value. Examples of assets include, but are not limited to, cash, equipment, and accounts receivable. This refers to the owner’s interest in the business or their claims on assets after all liabilities are subtracted. It is important to remember that the total of all assets has to equal the total of liabilities and equity.

The claims to the assets owned by a business entity are primarily divided into two types – the claims of creditors and the claims of owner of the business. In accounting, the claims of creditors are referred to as liabilities and the claims of owner are referred to as owner’s equity. The balance sheet reports the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such as December 31. The balance sheet is also referred to as the Statement of Financial Position. Whether you call it the accounting equation, the accounting formula, the balance sheet equation, the fundamental accounting equation, or the basic accounting equation, they all mean the same thing.

The accounting equation is fundamental to the double-entry bookkeeping practice. Its applications in accountancy and economics are thus diverse. These are some simple examples, but even the most complicated transactions can be recorded in a similar way.

This transaction also generates a profit of $1,000 for Sam Enterprises, which would increase the owner’s equity element of the equation. Incorrect classification of an expense does not affect the accounting equation. Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners. Most sole proprietors aren’t going to know the knowledge or understanding of how to break down the equity sections (OC, OD, R, and E) like this unless they have a finance background.

Said a different way, liabilities are creditors’ claims on company assets because this is the amount of assets creditors would own if the company liquidated. The accounting equation focuses on your balance sheet, which is a historical summary of your company, what you own, and what you owe. Additionally, you can use your cover letter to detail other experiences you have with the accounting equation. For example, you can talk about a time you balanced the books for a friend or family member’s small business.

The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet. The business has paid $250 cash (asset) to repay some of the loan (liability) resulting in both the cash and loan liability reducing by $250. $10,000 of cash (asset) will be received from the bank but the business must also record an equal amount representing the fact that the loan (liability) will eventually need to be repaid. The cash (asset) of the business will increase by $5,000 as will the amount representing the investment from Anushka as the owner of the business (capital).