The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received). If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory (an asset) while reducing cash capital (another asset). Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting. The balance of the total assets after considering all of the above transactions amounts to $36,450.

Do you already work with a financial advisor?

This equation is behind debits, credits, and journal entries. After the company formation, Speakers, Inc. needs to buy some equipment for installing speakers, so it purchases $20,000 of installation equipment from a manufacturer for cash. In this case, Speakers, Inc. uses its cash to buy another asset, so the asset account is decreased from the disbursement of cash and increased by the addition of installation equipment. Let’s take a look at the formation of a company to illustrate how the accounting equation works in a business situation. This long-form equation is called the expanded accounting equation.

Company

The balance sheet is also known as the statement of financial position and it reflects the accounting equation. The balance sheet reports a company’s assets, liabilities, and owner’s (or stockholders’) equity at a specific point in time. Like the accounting equation, it shows that a company’s total amount of assets equals the total amount of liabilities plus owner’s (or stockholders’) equity.

- As inventory (asset) has now been sold, it must be removed from the accounting records and a cost of sales (expense) figure recorded.

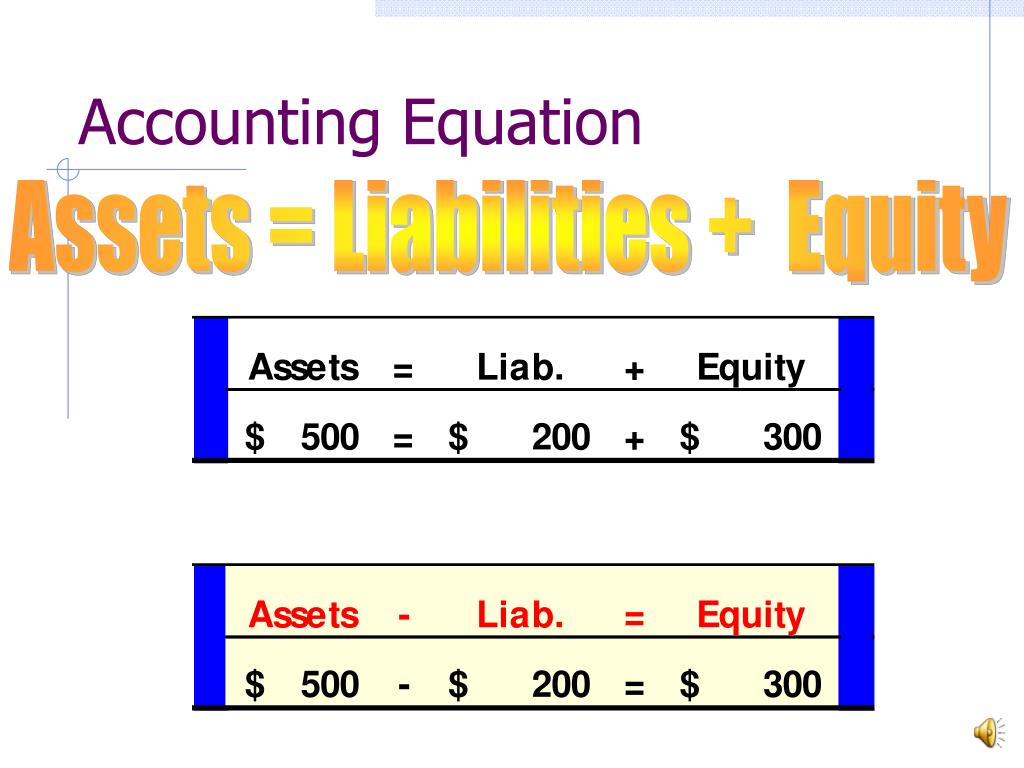

- From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner’s (or stockholders’) equity.

- The income statement will explain part of the change in the owner’s or stockholders’ equity during the time interval between two balance sheets.

Get in Touch With a Financial Advisor

Using Apple’s 2023 earnings report, we can find all the information we need for the accounting equation. However, equity can also be thought of as investments into the company either by founders, owners, public shareholders, or by customers buying products leading to higher revenue. The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof. Drawings are amounts taken out of the business by the business owner.

For example, if the total liabilities of a business are $50K and the owner’s equity is $30K, then the total assets must equal $80K ($50K + $30K). In above example, we have observed the impact of twelve different transactions on accounting equation. Notice that each transaction changes the dollar value of at least one of the basic elements of equation (i.e., assets, liabilities and owner’s equity) but the equation as a whole does not lose its balance. Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit). The accounting equation equates a company’s assets to its liabilities and equity. This shows all company assets are acquired by either debt or equity financing.

What if any one of these elements changes?

For example, when a company is started, its assets are first purchased with either cash the company received from loans or cash the company received from investors. Thus, all of the company’s assets stem from either creditors or investors i.e. liabilities and equity. With the how to manage timesheets in xero accounting equation expanded, financial analysts and accountants can better understand how a company structures its equity. Additionally, analysts can see how revenue and expenses change over time, and the effect of those changes on a business’s assets and liabilities.

To calculate the accounting equation, we first need to work out the amounts of each asset, liability, and equity in Laura’s business. Like any brand new business, it has no assets, liabilities, or equity at the start, which means that its accounting equation will have zero on both sides. If the net amount is a negative amount, it is referred to as a net loss. This arrangement is used to highlight the creditors instead of the owners.

To make the Accounting Equation topic even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our accounting equation visual tutorial, cheat sheet, flashcards, quick test, and more. When a company purchases goods or services from other companies on credit, a payable is recorded to show that the company promises to pay the other companies for their assets. Now that we have a basic understanding of the equation, let’s take a look at each accounting equation component starting with the assets.

That part of the accounting system which contains the balance sheet and income statement accounts used for recording transactions. In our examples below, we show how a given transaction affects the accounting equation. We also show how the same transaction affects specific accounts by providing the journal entry that is used to record the transaction in the company’s general ledger.

The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity. The income and retained earnings of the accounting equation is also an essential component in computing, understanding, and analyzing a firm’s income statement. This statement reflects profits and losses that are themselves determined by the calculations that make up the basic accounting equation. In other words, this equation allows businesses to determine revenue as well as prepare a statement of retained earnings. This then allows them to predict future profit trends and adjust business practices accordingly.