Assets typically hold positive economic value and can be liquified (turned into cash) in the future. Some assets are less liquid than others, making them harder to convert to cash. For instance, inventory is very liquid — the company can quickly sell it for money. Real estate, though, is less liquid — selling land or buildings for cash is time-consuming and can be difficult, depending on the market. It can be defined as the total number of dollars that a company would have left if it liquidated all of its assets and paid off all of its liabilities.

What if any one of these elements changes?

The impact of this transaction is a decrease in an asset (i.e., cash) and an addition of another asset (i.e., building). At this time, there is external equity or liability in Sam Enterprise. The only equity is Sam’s capital (i.e., owner’s equity amounting to $100,000). salary and wages The rights or claims to the properties are referred to as equities. Liabilities and capital were not affected in transaction #3. Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners.

What Happens if the Accounting Equation Is Not Balanced?

The Accounting Equation is the foundation of double-entry accounting because it displays that all assets are financed by borrowing money or paying with the money of the business’s shareholders. As expected, the sum of liabilities and equity is equal to $9350, matching the total value of assets. So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved. The accounting equation’s left side represents everything a business has (assets), and the right side shows what a business owes to creditors and owners (liabilities and equity).

Fact Checked

As a result of the transaction, an asset in the form of merchandise increases, leading to an increase in the total assets. At this point, let’s consider another example and see how various transactions affect the amounts of the elements in the accounting equation. The assets have been decreased by $696 but liabilities have decreased by $969 which must have caused the accounting equation to go out of balance.

The fundamental accounting equation, also called the balance sheet equation, is the foundation for the double-entry bookkeeping system and the cornerstone of accounting science. In the accounting equation, every transaction will have a debit and credit entry, and the total debits (left side) will equal the total credits (right side). In other words, the accounting equation will always be “in balance”. This straightforward relationship between assets, liabilities, and equity is the foundation of the double-entry accounting system. That is, each entry made on the Debit side has a corresponding entry on the Credit side. It’s a tool used by company leaders, investors, and analysts that better helps them understand the business’s financial health in terms of its assets versus liabilities and equity.

- This equation is the foundation of modern double entry system of accounting being used by small proprietors to large multinational corporations.

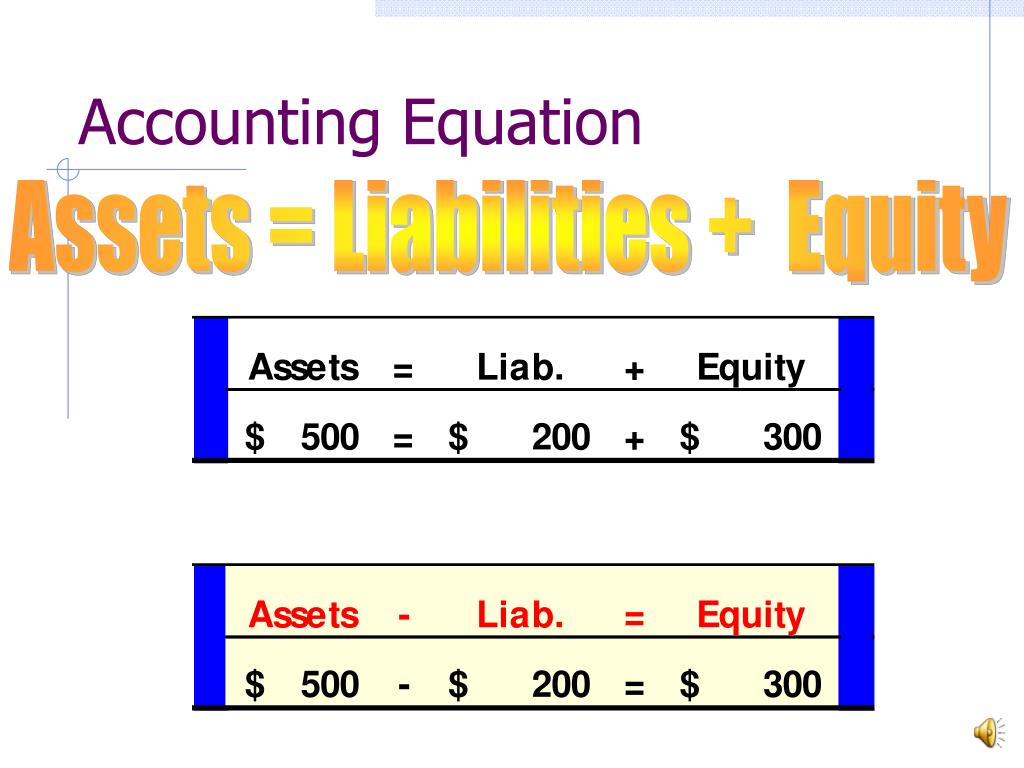

- Like the accounting equation, it shows that a company’s total amount of assets equals the total amount of liabilities plus owner’s (or stockholders’) equity.

- Real estate, though, is less liquid — selling land or buildings for cash is time-consuming and can be difficult, depending on the market.

- The inventory (asset) will decrease by $250 and a cost of sale (expense) will be recorded.

- On the other side of the equation, a liability (i.e., accounts payable) is created.

- Some assets are tangible like cash while others are theoretical or intangible like goodwill or copyrights.

In other words, the total amount of all assets will always equal the sum of liabilities and shareholders’ equity. The double-entry practice ensures that the accounting equation always remains balanced, meaning that the left-side value of the equation will always match the right-side value. We will now consider an example with various transactions within a business to see how each has a dual aspect and to demonstrate the cumulative effect on the accounting equation. In the case of a limited liability company, capital would be referred to as ‘Equity’.

The accounting equation shows how a company’s assets, liabilities, and equity are related and how a change in one results in a change to another. In the basic accounting equation, assets are equal to liabilities plus equity. For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts. For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. This equation should be supported by the information on a company’s balance sheet.

Unearned revenue from the money you have yet to receive for services or products that you have not yet delivered is considered a liability. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.