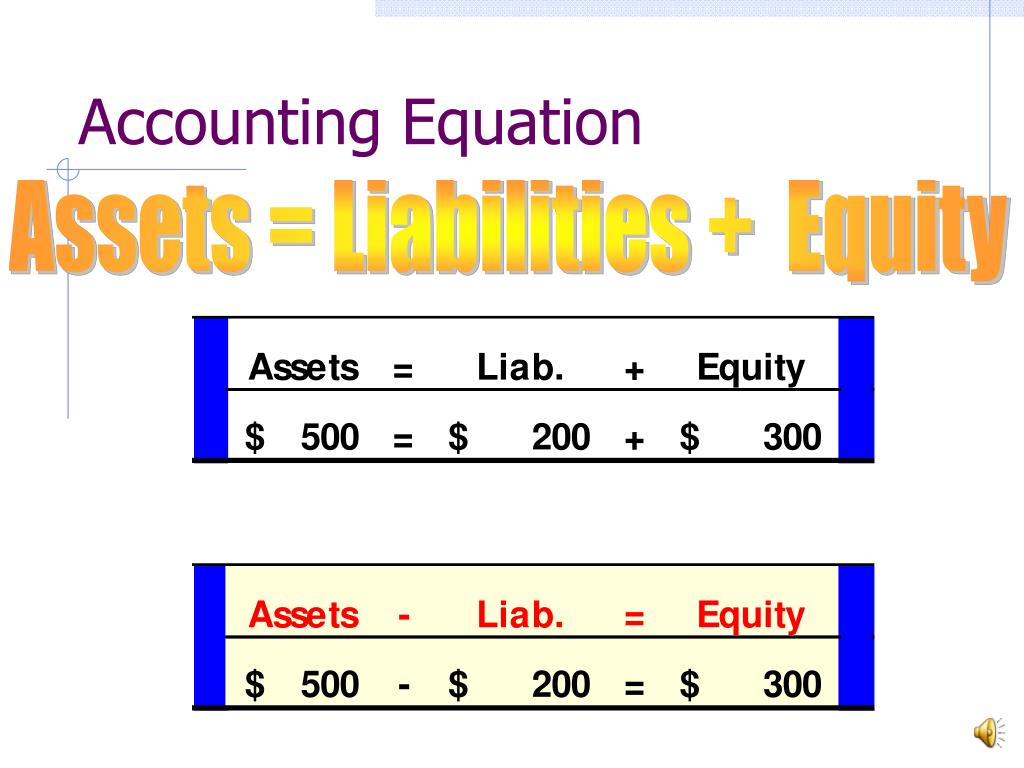

So, if a creditor or lender wants to highlight the owner’s equity, this version helps paint a clearer picture if all assets are sold, and the funds are used to settle debts first. A lender will better understand if enough assets cover the potential debt. The accounting equation is so fundamental to accounting that it’s often the first concept taught in entry-level courses.

- The accounting equation states that the amount of assets must be equal to liabilities plus shareholder or owner equity.

- This simple, easy-to-understand tool can tell you what you need to know upfront so you know what to focus on if there are any issues or room for improvement.

- The difference between the $400 income and $250 cost of sales represents a profit of $150.

Great! The Financial Professional Will Get Back To You Soon.

To calculate the accounting equation, we first need to work out the amounts of each asset, liability, and equity in Laura’s business. Like any brand new business, it has no assets, liabilities, or equity at the start, which means that its accounting equation will have zero on both sides. If the net amount is a negative amount, it is referred to as a net loss. This arrangement is used to highlight the creditors instead of the owners.

Showing You Understand the Accounting Equation on Resumes

It will always be true as long as all transactions are appropriately accounted for and can never fail or be out of balance for any given entity. It can also cause problems with taxes and audits, as well as customers who may suspect fraud or mishandling of funds as a result of an unbalanced equation. This formula represents the accounting identity, which must always be true for all entities regardless of their business activity.

Let us take a look at transaction #1:

Using Apple’s 2023 earnings report, we can find all the information we need for the accounting equation. However, equity can also be thought of as investments into the company either by founders, owners, public shareholders, or by customers buying products leading to higher revenue. The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof. Drawings are amounts taken out of the business by the business owner.

Impact of transactions on accounting equation

To learn more about the income statement, see Income Statement Outline. Parts 2 – 6 illustrate transactions involving a sole proprietorship.Parts 7 – 10 illustrate almost identical transactions as they would take place in a corporation.Click integrate pdffiller with xero here to skip to Part 7. Net value refers to the umbrella term that a company can keep after paying off all liabilities, also known as its book value. It specifically highlights the amount of ownership that the business owner(s) has.

The accounting equation is a factor in almost every aspect of your business accounting. This transaction would reduce cash by $9,500 and accounts payable by $10,000. The difference of $500 in the cash discount would be added to the owner’s equity. On 12 January, Sam Enterprises pays $10,000 cash to its accounts payable.

Accounts receivable list the amounts of money owed to the company by its customers for the sale of its products. Assets include cash and cash equivalents or liquid assets, which may include Treasury bills and certificates of deposit (CDs). However, this scenario is extremely rare because every transaction always has a corresponding entry on each side of the equation. Metro Corporation earned a total of $10,000 in service revenue from clients who will pay in 30 days.

To make the Accounting Equation topic even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our accounting equation visual tutorial, cheat sheet, flashcards, quick test, and more. When a company purchases goods or services from other companies on credit, a payable is recorded to show that the company promises to pay the other companies for their assets. Now that we have a basic understanding of the equation, let’s take a look at each accounting equation component starting with the assets.

The company acquired printers, hence, an increase in assets. Transaction #3 results in an increase in one asset (Service Equipment) and a decrease in another asset (Cash). If a transaction is completely omitted from the accounting books, it will not unbalance the accounting equation. However, due to the fact that accounting is kept on a historical basis, the equity is typically not the net worth of the organization. Often, a company may depreciate capital assets in 5–7 years, meaning that the assets will show on the books as less than their “real” value, or what they would be worth on the secondary market.